These amounts, when added or deducted from the cash book balance, give the balance as per bank statement or bank passbook. For example, a cheque written is immediately entered in the cash book, but it is not recorded in the bank until it is presented for payment. Checks that have been issued by the corporation to creditors but have not yet been processed are known as https://www.kelleysbookkeeping.com/ outstanding checks. Your current and prior months’ bank statements, along with your company ledger, are required to perform your bank reconciliation correctly. Match the deposits in the business records with those in the bank statement. To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly.

Step 1: Find the starting balance

This is because when you deposit a cheque in your bank account, you consider that the cheque has been cleared by the bank. It is important to note that such charges are not recorded by you as a business till the time your bank provides you with the bank statement at the end of every month. These outstanding deposits must be deducted from the balance as per the cash book in the bank reconciliation statement. The bank balance showcased in the passbook or the bank statement must match the balance reflected in the cash book of the customer. It is up to you, the customer, to reconcile the cash book with the bank statement and report any errors to the bank.

Bank Reconciliation Statement: Definition

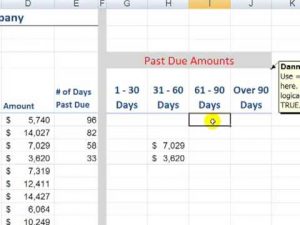

In today’s world, transactions (whether receipts or payments) are done via a bank. (e) Standing order payment of $1,500 (for rent) also fails to appear in the cash book. (b) Checks Nos. 789 and 791 for $5,890 and $920, respectively, do not appear on the bank statement, meaning these had not been presented for payment to the bank by 31 May. (a) Deposits made by Sara Loren on 30 May, $1,810, and on 31 May, $2,220, have not been credited to the bank statement. Examples include deposited checks returned for non-sufficient funds (NSF) or notes collected on the depositor’s behalf.

- Bankrate.com is an independent, advertising-supported publisher and comparison service.

- Otherwise, you’ll have to pursue the payee for the second check’s reimbursement.

- Similarly, when a business receives an invoice, it credits the amount of the invoice to accounts payable (on the balance sheet) and debits an expense (on the income statement) for the same amount.

- This may occur if you were subject to any fees, like a monthly maintenance fee or overdraft fee.

- Before sitting down to reconcile your business and bank records, gather your company ledger and the current and previous bank statements.

- To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly.

Who is Responsible for Performing a Bank Reconciliation?

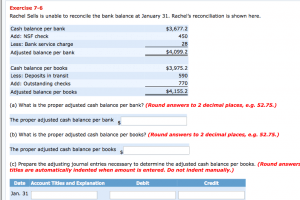

To guarantee that a company’s cash records are accurate, a BR should be done at regular intervals for all bank accounts. Otherwise, there is a risk that cash levels may be far lower than what the accounts say, which may result in bounced checks or overdraft costs. For doing this, you must add deposits in transit, deduct outstanding checks and add/deduct bank errors. The purpose behind preparing the bank reconciliation statement is to reconcile the difference between the balance as per the cash book and the balance as per the passbook. Such deposits are not showcased in the bank statement on the reconciliation date. This happens due to the time lag between when your business deposits cash or a cheque into its bank account and when your bank credits the same.

This can happen if you’re reconciling an account for the first time or if it wasn’t properly reconciled last month. There are bank-only transactions that your company’s accounting records most likely don’t account for. These transactions include interest income, bank deposits, and bank fees. If you use the accrual system of accounting, you might “debit” your cash account when you finish a project and the client says “the cheque is going in the mail today, I promise! Then when you do your bank reconciliation a month later, you realize that cheque never came, and the money isn’t in your books (even though your bookkeeping shows you got paid).

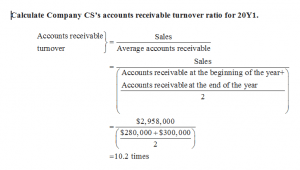

In such a case, your bank has recorded the receipts in your business account at the bank. As a result, the balance showcased in the bank passbook would be more than the balance shown in your company’s cash book. The first step in performing a bank reconciliation is to review the bank statement for any discrepancies or unidentified transactions. This includes reviewing all deposits, withdrawals, fees, and other bank charges made. Let’s assume that a new company opens its first checking account on June 4 with a deposit of $10,000.

The need and importance of a bank reconciliation statement are due to several factors. First, bank reconciliation statements provide a mechanism of internal control https://www.adprun.net/what-is-the-cost-of-factoring/ over cash. It’s vital businesses know what type of reconciliation to use and the bank reconciliation process flow in order to be as efficient as possible.

The change to the balance in your bank account will happen “naturally”—once the bank processes the outstanding transactions. If, on the other hand, you use cash basis accounting, then you record every transaction at the same time the bank does; there should be no discrepancy between your balance sheet and your bank statement. If you do your bookkeeping yourself, you should be prepared to reconcile your bank statements at regular intervals (more on that below). If you work with a bookkeeper or online bookkeeping service, they’ll handle it for you. In single-entry bookkeeping, every transaction is recorded just once (rather than twice, as in double-entry bookkeeping), as either income or an expense.

But, the cheque has not yet been cleared by the bank as a deduction from the company’s cash balance. As a result, the balance as per the bank statement is lower than the balance as per the cash book. Such a difference needs to be adjusted in your cash book before preparing the bank reconciliation statement. To create a bank reconciliation, you will need to gather your bank statements and reconcile them with your accounting records (ledger).

Before you reconcile your bank account, you should ensure that you record all the transactions of your business until the date of your bank statement. Typically, the difference between the cash book and passbook balance arises due to the items that appear only in the passbook. Therefore, it makes sense to first record these items in the cash book to determine the adjusted balance of the cash book. As mentioned above, debit balance as per the cash book refers to the deposits held in the bank.

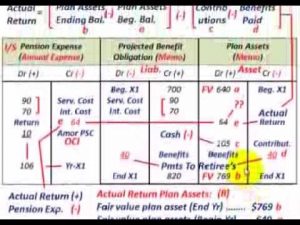

If a company’s bank statements show that it has $10,000 in cash, but the books only show that they have $9,000, then the company must perform reconciliation to identify the missing $1,000 in deposits. Some accounting apps will also automatically import your banking transactions, speeding up the reconciliation process. You will also need access to your company books for that same period of time, whether that’s in a spreadsheet, logbook or accounting software. Similarly, when a business receives an invoice, it credits the amount of the invoice to accounts payable (on the balance sheet) and debits an expense (on the income statement) for the same amount. When the company pays the bill, it debits accounts payable and credits the cash account. Again, the left (debit) and right (credit) sides of the journal entry should agree, reconciling to zero.

Common errors include entering an incorrect amount or omitting an amount from the bank statement. Compare the cash account’s general ledger to the bank statement to spot the errors. The four basic steps involved in the bank reconciliation process are described below. In addition, there may be cases where the bank has not cleared the cheques, however, the cheques have been deposited by your business. Therefore, the bank needs to add back the cheque’s amount to the bank balance. When your business issues a cheque to its suppliers or creditors, such amounts are immediately recorded on the credit side of your cash book.

However, the transactions that the bank is aware of but the company is not must be journalized in the entity’s records. The entries in the entity’s books to rectify the discovered discrepancies (except for the outstanding cheques) would typically be made in a subsequent date how to start a bookkeeping business in 8 steps or period, not backdated. When cheques become stale (ie., out of date), they would typically be reversed, not cancelled. Hence, at the end of each month, the first thing to do is to consult the bank reconciliation statement prepared at the end of the previous month.

The bank statement submitted by the businessman at the end of May will not contain an entry for the check, whereas the cash book will have the entry. Following the review and comparison of your internal bank records, with those on the bank statement, you will adjust your accounting records to reflect any discrepancies or unidentified transactions. If your beginning balance in your accounting software isn’t correct, the bank account won’t reconcile.